Here are three stories that caught our eye this week:

1) Easy Earnings Beat

Better than expected.

That’s what we hear most of the time when companies report quarterly earnings.

Why? Because it’s part of Wall Street’s dirty little secret.

Set a low bar for companies to beat earnings. Shares rise when the earnings beat comes across in the press release. Initiate higher price targets.

Rinse and repeat.

It’s no surprise companies are still beating 81% of S&P 500 companies are beating third-quarter earnings expectations despite all of the economic crosscurrents and breaking points we’ve been talking about.

From the Wall Street Journal:

“The third-quarter earnings season, meanwhile, has played out better than many investors expected. With the reporting period drawing to a close, 81% of S&P 500 companies that unveiled their results through Friday exceeded profit forecasts, higher than a 10-year average of 74%, according to John Butters, senior earnings analyst at FactSet.”

The 10-year average is 74%.

Said another way: The smartest and brightest on Wall Street — with the most advanced data sets and supercomputers — get it wrong 3/4 of the time.

Unsurprisingly, they underestimate a company’s earnings each quarter.

Most would say today’s economic conditions are more uncertain than ever before.

So what happens? Companies are beating estimates at 81% — the highest ever.

Again, it’s part of the game. The game to have ever higher share prices. (We’re not complaining, necessarily. Everyone gets wealthier with higher share prices.)

The point is that incentives get misaligned. And it leads to insane accounting adjustments from those same companies. From another Wall Street Journal article (emphasis added):

“More companies are beating analysts' expectations and by bigger amounts. Businesses' nontraditional earnings metrics are beating reported earnings by a lot more than last year, and a measure of the likelihood of earnings manipulation is at its highest level in about 40 years.

Companies have long engaged in earnings management, by which executives use the flexibility in accounting rules to improve reported earnings per share.

The moves, many of which are allowed under accounting rules, nonetheless have detractors. In a letter to investors earlier this year, Warren Buffett called the practice "one of the shames of capitalism."

One way companies are trying to make their results look better is to provide numbers that don't adhere to accounting standards – what are often referred to as pro forma measures – alongside the official data.

A report published Thursday by research firm Calcbench compared the net income based on accounting standards for 200 randomly selected companies in the S&P 500 with their adjusted net income, which can include or exclude items that would normally be counted. The adjusted numbers were higher by $1.1 billion on average last year, an increase of more than 130% over a similar sample from the year prior.

Another measure used to predict the likelihood of earnings flattery is the Beneish M-score, named for its creator, Indiana University accounting professor Messod Beneish. Recently, academics found the aggregate score of a sample of nearly 2,000 companies was at its highest level in more than 40 years, the most recent data shows. Historically, the aggregate score peaks ahead of a downturn.

First-quarter earnings exceeded expectations by an unusually large amount. Of the 485 companies on the S&P 500's roster that had reported first-quarter earnings as of May 26, 77% surpassed analysts' expectations, according to data provider Refinitiv. Since 1994, 66% of companies beat expectations in an average quarter.

The magnitude of the overperformance also stands out. Companies in aggregate are reporting earnings 6.9% above expectations, compared to a long-term average of 4.1%, according to Refinitiv. Some of that outperformance was the result of changes in the way the numbers were calculated.”

The Securities and Exchange Commission (SEC) is starting to take note. They’re starting to warn companies these pro forma adjustments could violate its rules.

But we haven’t seen much change. So expect more headlines of “X company beats forecast” with a subsequent share price bump thereafter.

That’s just part of the game.

2) The Tangible Benefit To AI

There’s a lot of money chasing narratives.

Everyone knows artificial intelligence (AI) is, and has been, the main narrative of the year.

Companies couldn’t mention it enough on their earnings calls. (H/T to the

for the chart.)It’s a cash grab. For companies and founders alike.

Companies who see their share prices spike higher. Founders who need to pivot to AI in order to stay alive.

But it’s not all bad.

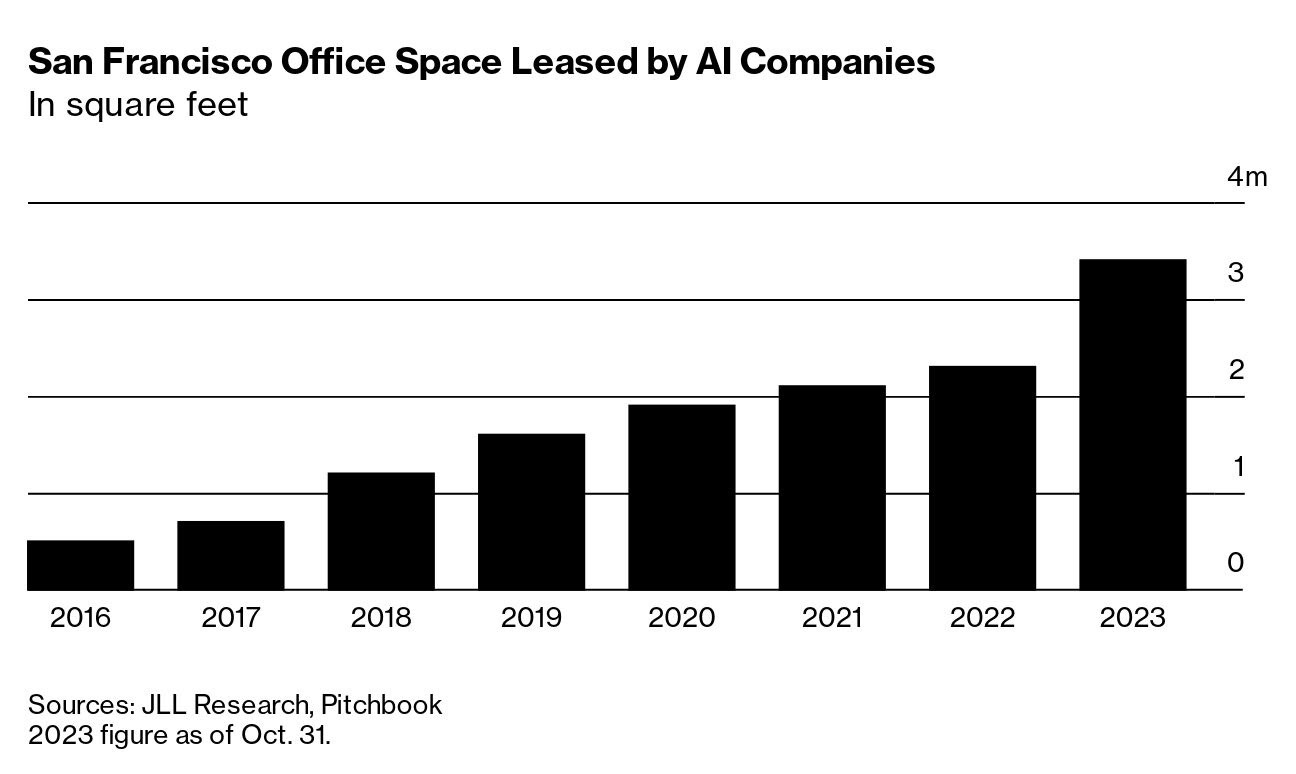

The hype cycle does spur economic activity. Check out how much of San Francisco’s office space has been leased by AI companies this year.

It seems AI companies are the ones saving San Francisco office space from truly imploding.

From Bloomberg (emphasis added):

“The city’s office vacancy rate reached a record 34% in the third quarter, according to the real estate brokerage CBRE Group Inc., yet AI companies have signed deals for more than 1 million square feet of San Francisco office space so far this year. That brings the industry’s total footprint to 3.4 million square feet, according to the real estate services company Jones Lang LaSalle Inc., up from 2.3 million square feet last year and seven times what it was in 2016…

All year, people have been referring to Hayes Valley, another nearby neighborhood, as “Cerebral Valley,” because of the recent reemergence of so-called hacker houses—spaces where people involved in tech live communally and work on their startups, often in repurposed homes…

As of early November, San Francisco’s office workers were showing up to work at about 44% of their pre-pandemic rates, according to Kastle Systems, which gathers data on how often employees check into their offices using key fobs or other devices. New York’s occupancy average was 51%, while Chicago’s was 55%. People in tech see AI as a way to bring San Francisco back to life."

It’s having an effect on the local economy as a result. More from Bloomberg:

“The AI boom has also been a boon to other businesses whose success relies on San Francisco’s biggest industry. Mickey Du, CEO of BrewBird, which makes a single-serve coffee maker, began placing its machines in offices in February. He says at least one-third of BrewBird’s potential clients have a strong AI component.”

Meanwhile, AI is driving cloud usage up to records.

Market research and information technology consulting firm Gartner expects the global cloud market will reach $678.8 billion in 2024 — a 20.4% increase from $563.6 billion this year. Gartner also expects cloud infrastructure is the segment expected to grow the most — at 26.6% in 2024.

Companies like Eli Lilly are using AI for drug discovery initiatives. Which is, in turn, driving their cloud storage costs much higher.

The takeaway: No one doubts the unlimited use cases AI will have on the world. We’re just scratching the surface of its potential.

We’ve spent a lot of time calling out the negative side of AI — i.e. Wall Street, companies, and founders cashing in on the hype cycle.

We’ve spent a lot of time calling out the negative side of AI — i.e. Wall Street, corporations, and founders cashing in on the hype cycle.

However, there are a lot of real economic benefits we’re seeing because of it. From jobs to leased office space to capital expenditures. Spending and growth is what the Federal Reserve is trying to prevent.

Meaning it’s become yet another economic crosscurrent.

3) Homeowner Update

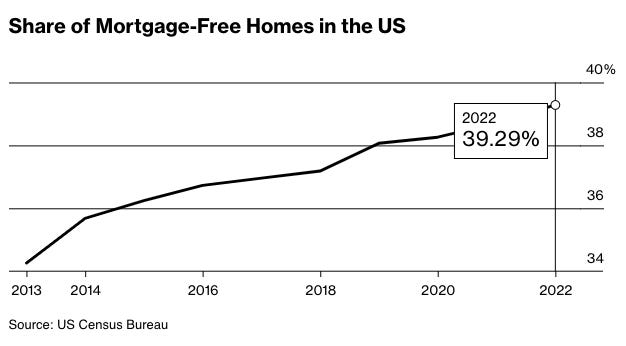

Forty percent.

That’s how many homeowners own their home outright as of 2022.

The rest of homeowners with a mortgage aren’t struggling.

Over 90% have a mortgage below 5%.

Home equity is the reason why the consumer-led economy is holding up better than anyone thought. Despite all the economic crosscurrents and breaking points we’ve been talking about.

We may be in a recession. Or we may be headed into recession.

But we’re not headed for a global collapse like the Great Recession in 2008.

Many homeowners were underwater on their homes in 2008. They had to turn the keys back over to the banks.

Now 40% of them own their home free and clear. The rest have very low interest rates.

Meaning all the wage gains (see a couple of our posts here and here) we’re seeing across the country flow straight into a user’s bottom line — aka their discretionary income.

From Bloomberg (emphasis added):

“That’s true for Mike Dallas, 61, who says not owing the bank each month brings a big sense of relief. ‘I knew that I could not lose my house to foreclosure,’ says the commercial real estate broker from Austin. ‘Now all I have to worry about is the tax collector.’

Anthony Stump, 38, paid off his 30-year mortgage in just nine years, which he says allows him to live the lifestyle of someone with at least twice his annual income. The software engineer and his wife, Emily, who’s a nurse, made extra monthly payments and used one-off windfalls such as tax refunds to pay down the loan on their home in Lenexa, Kansas. ‘I know the financial argument, but it’s more the security,’ says Stump.”

The silver lining of the Great Recession was financial security of one’s home — the most important asset — became priority #1.

Meanwhile, we’re seeing Americans plow trillions into money-market accounts and U.S. Treasury bonds.

High interest rates are making their way through the economy.

From iconic retail bankruptcies to credit card and auto loan delinquencies. From a bear market in many assets to the IPO window closing. From a global shipping bear market to soaring U.S. deficits.

These are concerning. Ones that are leading us to an economic breaking point.

But there’s one thing we don’t have to worry about.

Americans getting kicked out of their homes.

Good investing,

Lance

P.S. We want to wish all of our American readers a Happy Thanksgiving week.