Here are three stories that caught our eye this week:

1) A Failed Second Act

“You either die a hero… or live long enough to see yourself become the villain.” — Harvey Dent in The Dark Knight. (You can watch the clip here.)

Bob Iger — CEO of Disney — is starting to see himself become the villain.

Iger had one of the most successful first stints of a CEO at Disney.

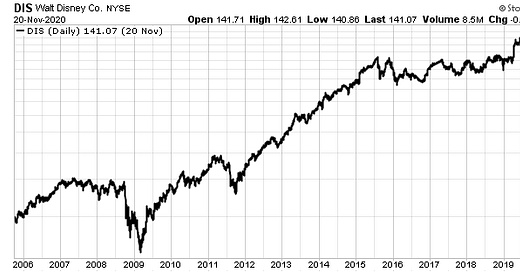

Iger was CEO of Disney from 2005-2020. He oversaw the acquisitions of Pixar, Marvel Entertainment, Lucasfilm and 21st Century. The prices on these acquisitions were steals. He also helped turn Disney parks and cruises into true vacation destinations.

Disney returned more than 4x (not including dividends) over his tenure.

Then Iger decided to sail off into the sunset… passing the baton to one of his former lieutenants, Bob Chapek.

Chapek fumbled several PR situations. Disney shares plummeted as a result. Disney was down almost 33% during his tenure. And 51% from its 2021 highs.

Disney shareholders were looking for a savior. Who better to turn to than Iger?

From Bloomberg:

“‘Of 8 billion people, they got the person who has the greatest chance, greatest capability to actually solve these problems,’ Jeffrey Katzenberg, the former head of Disney’s studio division and a co-founder of DreamWorks, said at the time…

‘For Bob, leaving Disney was like a father abandoning his favorite child,’ says a current Disney executive close to Iger. ‘The good news is Daddy’s back, but the bad news is that the house is on fire.’”

Well, Iger has been CEO for 11 months now. And has picked up where Chapek left off…

He’s pissed off pretty much everyone. From the writers to the actors to Disney fans.

More from Bloomberg (emphasis added):

“Investors barely had time to cheer before the news was overshadowed by an Iger gaffe on the eve of actors joining writers in a strike, the first time both unions had banded together in 60 years. Iger had a long-earned reputation as a dealmaker and diplomat, having played a major role in thawing the ice between studios and scribes at the height of the Writers Guild of America strike in the late aughts. But when asked by CNBC about the actors’ demands, which include better payment from streaming services and job protections against AI, Disney’s chief executive officer said: “There’s a level of expectation that they have, that is just not realistic.”

Within hours, Iger went from being the champion of creatives to an avatar for everything wrong with the entertainment industry in 2023. “There he is, sitting in his designer clothes and just got off his private jet at the billionaires’ camp, telling us we’re unrealistic when he’s making $78,000 a day. How do you deal with someone like that who’s so tone-deaf?” railed Fran Drescher, president of SAG-Aftra, which represents 160,000 actors. On picket lines, Sean Gunn, an actor in Disney’s Guardians of the Galaxy series, said, “Bob Iger makes 400 times what his lowest worker is making, and I think that’s a f---ing shame.” Nearly a month later, he was still being held up as the villain. “To hear Bob Iger say that our demands for a living wage are unrealistic?” actor and writer Billy Porter said in an interview about selling his house because of lost income during the strikes.

But Iger has suffered more setbacks in 11 months than he did during his first 15 years at Disney’s helm, with some problems unforeseen and others years in the making. Disney is now a business saddled with a dying TV division that Iger all but put on the block in that CNBC interview, declaring it “may not be core” to the company’s future. Disney+ has lost the company more than $2 billion so far this year and is bleeding subscribers as it tries to raise prices. Setting aside last year’s Avatar: The Way of Water (which is now the subject of a breach-of-contract suit filed by the film’s financier), its movie division is suffering from a string of box-office bombs that call into question its most prized franchises. Even Disney World in Florida is reporting lower attendance. Iger blamed the humidity.

Like Apple’s Steve Jobs and Starbucks’ Howard Schultz, Iger was a star CEO whose identity had become indistinguishable from the company he helped build. But his second tour is looking less like a Jobsian triumphant return than a Schultzian descent into financial mediocrity and employee acrimony. Disney declined to make Iger available for an interview, but members of his inner circle and current and former Disney employees, who declined to be named as they aren’t authorized to speak publicly, describe him as overwhelmed and exhausted.”

It’s easy to see how a 15-year tenure filled with undeniable success could lead to a confidence level bordering on arrogance.

It’s probably what led Iger to want to come back and play hero once again.

Eleven months in… it looks like he’s lost all of his goodwill from his first term. And has been vilified by his base. (We highly recommend reading the whole Bloomberg article.)

Disney shares are down another 13%+ since Iger came back. There isn’t much optimism amongst shareholders either, outside of speculation that Iger wants to sell Disney to Apple.

Iger truly has lived long enough to see himself become the villain.

2) The Ivory Tower

Inflation is dead…

Or so we’re told by the “elites” in the ivory tower.

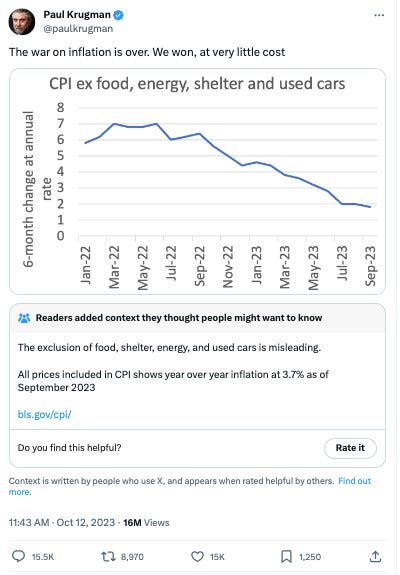

Here’s Nobel Prize laureate and famed economist Paul Krugman:

Keen observers will notice Krugman excluded food, energy, shelter, and used cars to show inflation is back down to the Fed’s 2% mandate.

Ah, yes… exclude the most essential expenses to the average person. Makes sense.

Global food prices are up 25% since 2020:

Oil prices are up more than 100% since 2020 and up more than 26% in the last 3 months alone:

And home prices have gone parabolic. Mortgage payments too. Which you’ve probably seen, read, or witness firsthand everyday for the last few years.

Used cars are still more expensive than new cars in some cases.

There’s inflation everywhere. Good inflation and bad inflation.

Good inflation like employees or companies getting paid to do nothing. Or union workers getting paid higher salaries. Or the American consumer spending hundreds, or even thousands, of dollars seeing Taylor Swift or Beyoncé.

Bad inflation like food, energy, and shelter.

Krugman tells us not to worry though… as everything else is down. (Maybe Krugman read our piece about the bear market in luxury watches?)

Krugman’s tweet reached 16 million impressions and was so misguided… Twitter (now known as X) was forced to put out a “community note” providing more context.

Other political figures have reiterated similar sentiments. From investment research firm Hedgeye:

The Fed’s Austan Goolsbee recently said he sees no clear signals that the U.S. economy is veering off the "golden path" toward the Fed's 2% inflation goal and at the same time averting a recession

Treasury Secretary Janet Yellen said recently, "I don't see any sign that the economy is at risk of a downturn."

The Fed’s Christopher Waller said recently, “In the last three months inflation data has been very good.”

Federal Reserve Chairman Jay Powell has reiterated rates will be higher for longer. That he’ll do whatever it takes to combat inflation.

But the real risk is if the Fed blinks too early and cuts rates. That would lead us to stagflation — sluggish growth with high inflation.

The risk grows more and more with all these economic crosscurrents.

The only thing we can do is watch from the sidelines. And hope they make the right decision from their ivory tower.

3) Rite Aid Goes Bankrupt

We’ve seen yet another iconic American brand go bankrupt.

Rite Aid filed for Chapter 11 bankruptcy on Sunday, October 15th.

Rite Aid was losing money every year on top of an upside down balance sheet — with $4 billion in debt.

Their stock is down more than 99% over the past couple of years.

Rite Aid was a zombie company — one who only survived due to free money. They’ve been headed for bankruptcy for years… like Blue Apron and Bed Bath & Beyond.

Longtime readers know we’ve been writing about the distortion in the world of finance due to zero percent interest rates.

We called the Bed Bath & Beyond bankruptcy a canary in the coal mine for many other companies. Here’s what we said earlier this year.

“Get ready for the “everything must go” sale at Bed Bath & Beyond.

Last week, Bed Bath & Beyond (BBBY) said it has “substantial doubt” it can stay in business.

The death of BBBY is a slow one. One that would’ve happened years ago had it not been for a free, zero-interest rate world.

Why? Because it’s a flawed company you want to avoid at all cost…

We’re focusing on BBBY to show you it’s a canary in the coal mine.

Hundreds of companies — public and private alike — won’t make it in this higher interest rate cycle.

The market has already priced in a lot of pain. Many tech companies are down 50-80%. Some are even down 90%.

But there’s a lot more pain ahead. Creditors have all the leverage now.

Many companies’ business models were based on cheap/free money. Now they’ll have to raise money and/or refinance at very costly terms.

Bed Bath won’t be the last company hitting the headlines of bankruptcy risk.

Check your portfolio. Expect the share price to remain under pressure if those companies don’t make money or have fortress balance sheets. Or worse… they go the way of Bed Bath & Beyond.”

The tide is going out. The capital window has closed. And bankruptcies of companies above $50 million are soaring.

More companies have gone bankrupt in 2023 than 2021-2022 combined.

Rite Aid going belly up is just another casualty of a higher interest rate environment. But they won’t be the last.

Expect a lot more companies to file for Chapter 11 in the coming months.

Good investing,

Lance

Great coverage!!