Here are three stories that caught our eye this week:

1) A Very Profitable Vice

Certain industries have been around for thousands of years. They’re timeless.

We’re talking about vices: booze, tobacco, gambling, and sex.

Some of the wealthiest people in recorded history have had their hands in these industries. And there’s a reason why.

They’re some of the most lucrative businesses in the world.

That remains true today.

Leonid Radvinsky created OnlyFans — a platform where creators can upload videos for their subscribers. Subscribers then pay a subscription fee for exclusive content.

A large percentage of platform creators are uploading sexual content. OnlyFans has become synonymous with this vice.

Business is booming.

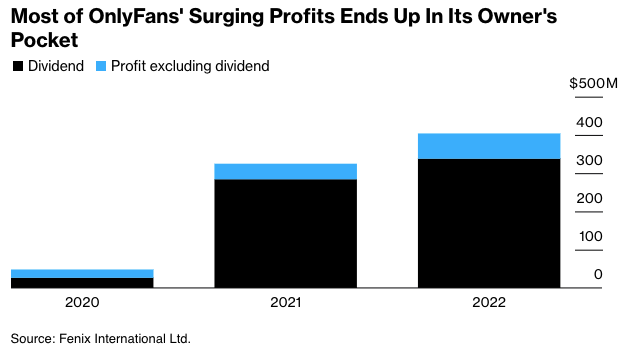

So much so, Radvinsky paid himself a $284 million dividend in 2021. And a $338 million dividend last year.

OnlyFans generated $1.09 billion in revenue in 2022. Profits were $403.7 million.

Selling sex online has 40% net income margins.

Apple and Google — known as some of the greatest cash-generating businesses of all time — have roughly 25% net income margins.

Incredible.

2) Outflows From Luxury Watches

Wealthy people are flooding into Tokyo real estate… and out of luxury watches.

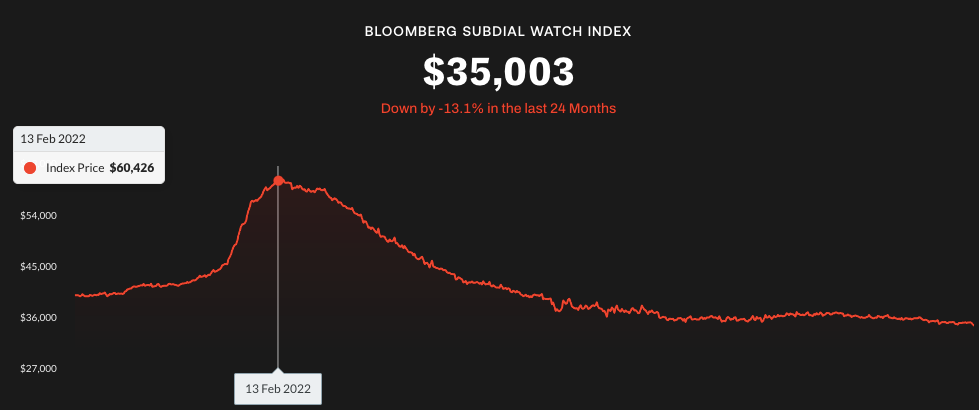

The average price of luxury watches — like Rolex and Patek Philippe — keep falling. They’re down more than 42% from the February 2022 peak according to the Bloomberg Subdial Watch Index. It tracks prices for the 50 most traded watches on the secondary market.

Luxury watches were a very speculative market during the Pandemic frenzy of 2020 - early 2022. Everything was soaring.

Longtime readers know we almost nailed the peak of the market in our November 16th, 2021 missive Don’t Fall For The Trap:

“Everyone’s getting rich right now.

Everyone’s got cash ready to spend and invest.

Every asset is at or near all-time highs.

Stocks. Bonds. Crypto. Real Estate. Art. New and Used Cars. Watches. Collectibles.

My guess is you’ve heard or read about some average Joe making millions, by getting lucky. Or maybe your friends and family are telling you how much money they’re making from some stock or cryptocurrency.

I keep getting texts from my friends – old and new – about how much they’re making in stock options and altcoins. They don’t know exactly what they’re doing or what the company does.. But they’re making money anyway.

This is what happens towards the end of a bull market. The mania phase.

Everyone’s feeling good. Everyone’s making money. Everyone’s ready to gamble with just a little bit more of their money to go for that moonshot.

The FOMO (Fear Of Missing Out) is real.

It’s probably making you want to dabble in certain asset classes you wouldn’t have ever gotten into.

Speculations like day-trading. Cryptos. NFTs. Call options. Biotechs. You name it.

It’s all exciting and attractive. This idea of making many multiples on your money very quickly. The thrill feels like you’re in a casino. If just one of these moonshots hit, it’ll change your life.

Mania phases like these suck you in like a blackhole. Making you want to invest more and more of your money into speculative ideas.

Don’t succumb to the temptation.

Times like these are not normal. Getting caught up in this market will slaughter the average investor.”

The market proceeded to fall more than 20% from peak to trough over the following 12 months

Luxury watches were caught up in the frenzy. But they’re also considered a store of value.

So the fact that luxury watch prices keep falling means the wealthy are less concerned about inflation than meets the eye… Despite major crosscurrents showing inflation — like wage inflation — is here to stay.

These sorts of crosscurrents are what make markets and investing so hard.

Our advice remains the same: Be vigilant out there.

3) The Federal Reserve Sticks To Their Guns

The market just doesn’t get it.

They listen to Federal Reserve (Fed) Chair Jerome Powell speak roughly once a month.

Powell tells investors he’s serious about combating inflation. Each time the market rolls its eyes in disbelief. Each time the market gets caught flat-footed.

The Fed has too much egg on its face due to its horrific “transitory” call on inflation. It’s why we told longtime readers back in June 2022, The Fed Isn’t Going To Stop:

“The Federal Reserve doesn’t care how much more wealth of yours it has to destroy in order to get inflation back to its 2% mandate.

Federal Reserve Chairman Jerome Powell made that very clear during his press conference last Wednesday… after the Fed raised interest rates 75 basis points — the most since 1994:

“We won’t declare victory until we see a series of consecutive, sharp declines in the monthly rate of inflation.”

Powell also said:

‘‘We’d like to see positive real interest rates across the entire curve. That will make us more comfortable that inflation will be slowing down.’’

You see, the Federal Reserve committee and the entire U.S. government have a lot of egg on their faces.

They’ve been saying inflation was transitory throughout all of 2021 and early 2022.

They can’t deny it anymore. Inflation hasn’t come down. It’s accelerated.

Meaning they will do whatever it takes to bring it down… and save their credibility.”

The market has been wrong time and again. We’ve written about it ad nauseam how the Fed will not stop until they’ve put millions of people out of work.

One again… the market didn’t believe Powell.

Here’s what Powell said this past Friday:

“We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

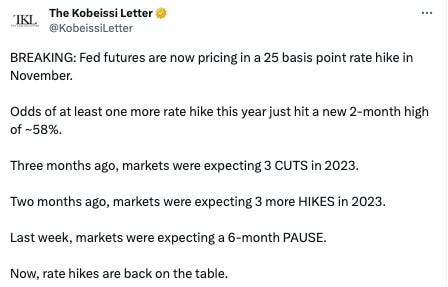

Just a couple months ago, the markets were pricing in rate cuts by the end of the year.

From market research firm The Kobeissi Letter on X (formerly Twitter):

We’re not sure when the markets will understand that the Federal Reserve doesn’t care if things break. The Fed doesn’t care if you lose money. And it doesn’t care if they put people out of work — that’s the goal.

Their concern is getting inflation down to 2%.

Something will break. We don’t know what or how. But things are starting to crack. We had the bank run a couple months ago. We still have more than $2 trillion in negative yielding debt. Big bankruptcies ($50+ million businesses) are picking up. And our government’s interest expense is going exponential.

We’ll echo ourselves once again from the point above: Be vigilant out there.

Good investing,

Lance

great take, thank you!