Spotify Making Moves | Manufacturing Boom | Commercial Real Estate Losses

Here are three stories that caught our eye this week:

1) Spotify Figured It Out

The benefit of a higher-interest rate world is it forces companies to be self-sufficient.

No longer can companies raise money for free to fund money-losing ventures. Companies no longer get cheered on for growing at all costs. They don’t get rewarded with higher share prices by selling $1 for $0.90.

The cost to borrow money isn’t free anymore. Meaning companies have to actually make business-oriented decisions. Decisions that dictate whether they’ll survive.

Spotify is one of those companies who is evolving with the times.

Longtime readers are familiar with Spotify’s struggling business model. We put them in the bucket of “great product, bad investment” back in February 2023. Here’s what we said:

“The big issue… Spotify has never made a net profit in its history.

Despite growing quarterly revenues 6x over the past six years… its gross profit margins haven’t budged — ranging in the mid-20s.

Spotify’s service is fantastic. There’s a reason it’s the leader in both music and podcasting. There’s a reason Apple hasn’t closed the gap.

But that doesn’t mean it’s a good investment.

In fact, Spotify hasn’t made money for investors since it went public in 2018.”

Spotify pays most of its revenue back to music labels. This effectively caps its profit margins.

Wall Street wants to see profits in a positive interest rate world — i.e. the one we’re in now. We wrote about Spotify doing it’s best to turn profitable this past December.

Spotify is expected to lose over €500 million in 2023 when they report full-year earnings this morning. (We finished this piece before Spotify announced).

But CEO Daniel Ek is putting them on a path to profitability. First, they cut 17% of their workforce. And late last week, they announced a new $250 million deal with Joe Rogan.

Here’s Bloomberg with the details (emphasis added):

“Rogan, who hosts an extended chat show, signed his previous contract in 2020. It was reportedly worth $200 million, but was exclusive to Spotify. In addition to being available on the podcasting platforms, Rogan will share in the revenue his program generates, according to people familiar with the terms who asked to not be identified. The Wall Street Journal reported that the new deal was worth $250 million…

Rogan typically releases three or four shows per week, in both an audio and video formats, and has produced more than 2,300 over 14 years, according to Jrelibray.com, a site that tracks his work.

Recently, Spotify has been shifting its podcast strategy away from audio exclusives in an effort to maximize audiences and advertising revenue. Just this week, it began releasing Alex Cooper’s Call Her Daddy program widely on such services as Apple Podcasts and Amazon Music.”

Astute readers will note Spotify’s major pivot.

They’re letting Rogan stream his content on all platforms.

Most companies sign exclusive rights for a reason. They want subscribers all to themselves.

Spotify is going the other way.

Why? Because they’re getting a revenue share on Rogan’s accounts on other platforms.

Rogan was the #1 podcaster on YouTube — before Spotify. And he stayed the #1 podcaster once he moved to Spotify.

The amount of money Spotify will make on Rogan from other platforms flows straight to its bottom line.

You see the same moves being made with television and movie content publishers licensing their content to Netflix. Streaming is a money-losing business. Netflix is the Goliath. The only way to stay in the game is to license content to Goliath.

Spotify saw the writing on the wall with YouTube and TikTok. So it’s licensing its exclusive rights to Rogan in the same manner.

This is the move that makes us interested in Spotify as an investment.

Expect upbeat guidance on profitability from Spotify’s earnings call.

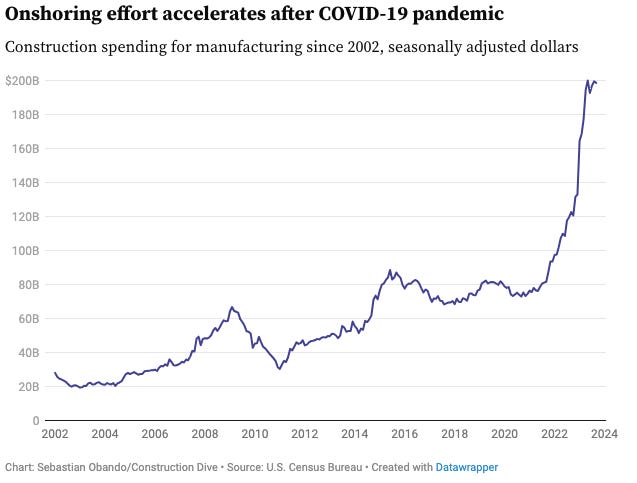

2) Manufacturing Boom

It’s been a “once-in-a-lifetime” opportunity for manufacturers in the U.S.

Private companies have spent more than half a trillion dollars since 2021 to onshore facilities back to the U.S., according to the White House.

“I haven’t seen in the last 25 years anything like this,” said Caldwell, president and CEO of Global Location Strategies, a Greenville, South Carolina-based business consulting and services firm for capital, labor, energy and water intensive manufacturers. “This is a once-in-a-lifetime or a once-in-a-century-type event that we’re experiencing.”

The amount of money flowing into U.S. manufacturing is hard to fathom.

COVID-19 is what made manufacturing spend go exponential. Then came the Infrastructure & Jobs Act.

The money is good for everyone: Businesses, employees, and even the U.S. government.

Businesses get to grow. Employees get to make more money. And the U.S. government gets higher tax revenue, employment gains, and a reduction in geopolitical risk by onshoring production.

We’re also seeing booms in space real estate as well as artificial intelligence (A.I.) real estate.

The only issue is it’s all inflationary. (Albeit good inflation.)

It’s causing major economic crosscurrents that’s confusing economists and the Federal Reserve.

We mentioned the ripple effects this is having on markets. Markets keep underestimating the Fed. And they’ve just done it again.

Regardless, manufacturing coming back to the United States is a good thing! Let’s give ourselves a pat on the back at least once?

3) Nobody Knows Where The Losses Are

Barry Sternlicht knows a thing or two about commercial real estate.

Sternlicht has decades of experience buying and selling billions of dollars in real estate. He worked with legendary real estate investor Sam Zell too.

Sternlicht launched Starwood Capital Group which now manages over $100 billion.

It’s wise to listen to Sternlicht when he speaks.

Most people know commercial real estate is in a bear market. But nobody knows how bad things are. Not even Sternlicht. However, he is aware there’s at least $1.2 trillion in losses across commercial real estate.

From Bloomberg (emphasis added):

“Once a $3 trillion asset class, offices now are ‘probably worth $1.8 trillion,’ said Sternlicht, chief executive officer of Starwood Capital Group. ‘There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.’”

There’s a lot of losses that nobody wants to realize. From banks to lenders to individuals.

The issue is… these lenders will have to realize the losses soon.

More from Bloomberg (emphasis added):

“Banks are facing roughly $560 billion in commercial real estate maturities by the end of 2025, according to commercial real estate data provider Trepp, representing more than half of the total property debt coming due over that period. Regional lenders in particular are more exposed to the industry, and stand to be hit harder than their larger peers because they lack the large credit card portfolios or investment-banking businesses that can insulate them…

Commercial real estate loans account for 28.7% of assets at small banks, compared with just 6.5% at bigger lenders, according to a JPMorgan Chase & Co. report published in April. That exposure has prompted additional scrutiny from regulators, already on high alert following last year’s regional banking tumult.

“It’s clear that the link between commercial property and regional banks is a tail risk for 2024, and if any cracks emerge, they could be in the commercial, housing and bank sector,” Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place, said.

While real estate troubles, particularly for offices, have been apparent in the nearly four years since the pandemic, the property market has in some ways been in limbo: Transactions have plunged because of uncertainty among both buyers and sellers over how much buildings are worth.”

Sternlicht believes there’s a lot of pain ahead. But he’s taking advantage where he sees opportunity.

‘We’re in the business of getting loans,’ he said. The banks ‘don’t show up, they’re not even playing. So the alternatives are the debt funds, which are having a field day.’”

We’re following right behind Sternlicht at The Partners Fund. It’s one of the primary reasons we launched the fund in the first place.

The illiquidity is allowing us to be price makers. Not price takers.

The commercial real estate losses are forcing lenders to get rid of some of their premiere assets. It’s filtering through into the rest of the real estate.

The deals coming across our desk are ones we haven’t seen in years.

Real estate deals are selling between 20-50% below replacement cost. Cap rates are moving up. And collateral is being guaranteed (in some instances).

The Partners Fund has taken advantage and has invested in and committed to four real estate deals already. Expect to hear more about our deals in upcoming missives.

Good investing,

Lance

DISCLAIMER: This is solely our opinion based on our observations and interpretations of events. This should not be construed as personal investment advice.