The Grass Is Greener | Fizzled Frenzy | Reversion To The Mean

Here are three stories that caught our eye this week:

1) Not As Bad As In China

There’s a lot of concerning economic trends in the U.S.

U.S. government deficits. Credit card debt. Auto loan debt. Mortgage rates and skyrocketing rent. Etc…

One thing we should all be fortunate for here in the U.S. is low unemployment.

Unemployment has remained stubbornly low for the Federal Reserve. They mentioned they want to put millions out of work… as it’s one of their data points they’re using to cool inflation.

They’re likely going to break something based on this crosscurrent. But low unemployment is a good thing!

Not just for economic sake… for societal and humanity sake.

The same can’t be said for China… especially young adults.

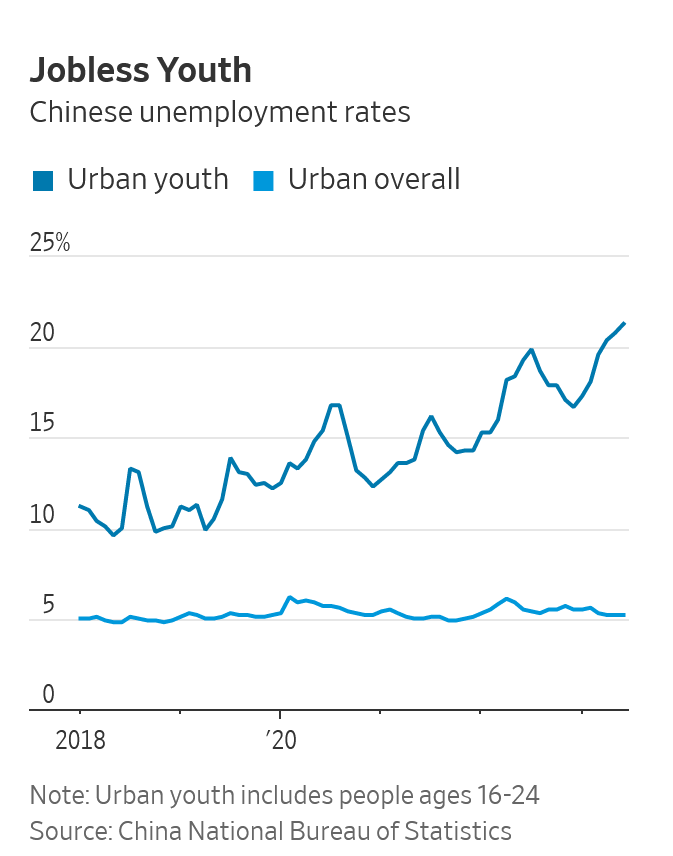

More than one in five young people in China are jobless according to The Wall Street Journal (WSJ).

From WSJ (emphasis added):

“Young people need to stiffen their spines and embrace hardship, says leader Xi Jinping, who labored in the countryside in China’s Cultural Revolution. If they can’t find jobs they want, they should work on factory lines or engage in poverty relief in rural China.

The government’s guidance is ringing hollow with many young people. Growing up in a period of rising prosperity, they were told that China was strong, the West was declining and endless opportunities awaited them. Now, with the urban youth unemployment rate hitting a record of 21.3% in June, their employment frustrations are posing a new challenge to Xi and his vision for a more powerful China.

For the estimated 11.6 million college graduates in 2023, having heeded calls by the state to study hard, the prospect of resorting to the physical labor that many of their parents performed is distinctly unappealing…

…The problem isn’t that jobs don’t exist in China. They do. With its shrinking population, China needs workers as much as ever. It is that China’s weakened economy isn’t producing enough of the high-skill, high-wage jobs that many college students have come to expect.

Disenchanted, many young people are opting out of the job market entirely, or “lying flat,” as many of them call it. Chinese media has recently featured articles about young “drifters” who live hand-to-mouth and pick up odd jobs as they roam the country.

Many of those who still want to work have soured on the private sector, with surging numbers of people sitting for the country’s civil-service exam for a chance at a low-paid, but stable, role in China’s bureaucracy.

The true level of China’s unemployment rate for young people ages 16 to 24 may be even higher than indicated by official data. Zhang Dandan, a Peking University economist, estimated the real youth unemployment rate in March could have reached 46.5%, compared with the official figure that month of less than 20%, if the millions of people who aren’t participating in the workforce also were counted.”

Both official or unofficial unemployment numbers are horrifying.

(For reference, youth unemployment across the European Union is almost 14%. It’s just 7.5% here in the U.S.)

There are, and will be, significant global repercussions as a result from this. Many above our pay grade.

Either way, we’re lucky here in the United States. Things could always be worse.

2) Exodus Of Inflation-Backed Bonds

Herd mentality rears its head again.

Everyone rushed into U.S. government inflation-backed bonds (I bonds) last year when inflation was 9%+.

The shills on social media about how it was the biggest no brainer were raging. It was all you could read about (if you follow any financial-based circles in social media).

Turns out… now everyone is selling despite a 10% penalty on those who bought recently. U.S. I-bond sales have literally dropped 99% as investors can find better funds elsewhere.

From Bloomberg (emphasis added):

“Since the yield on Series I savings bonds dropped in May, investors have redeemed about $800 million worth of the securities, more than in all of 2021…

As rising prices diminished the value of cash last year, I bonds — which yielded a record high interest rate of 9.62% between May and November 2022 — became all the rage. And even when the yield dropped to 6.89% in November, investors were still pouring in billions.

Now, inflation is finally slowing down, and the I bond yield fell to just 4.3% in May. That caused net sales to plunge to just $40 million so far in July, a 99% decline when compared with the $4 billion purchased in January.”

Money does truly flow where it’s treated best.

3) Reversion To The Mean

The world changed forever due to COVID-19.

Or has it?

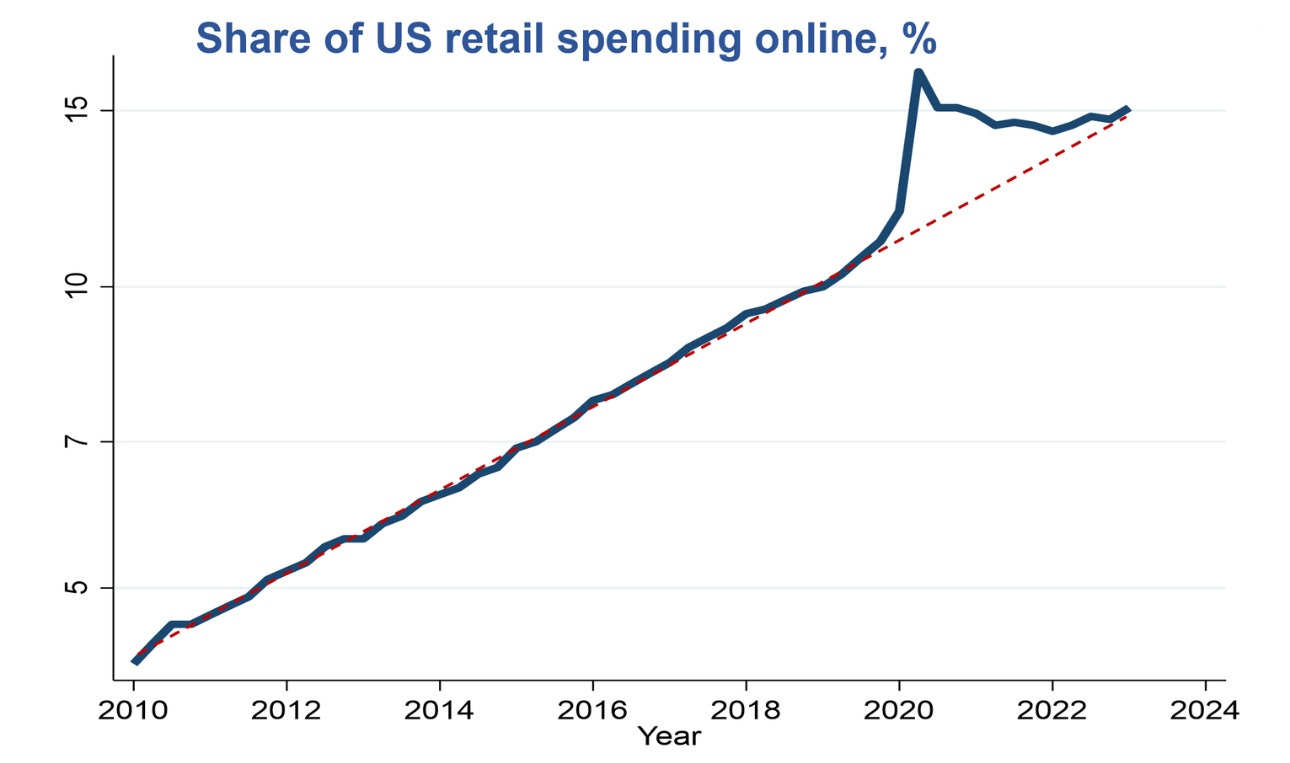

E-commerce sales exploded while everyone was forced to stay at home.

Businesses went all-in on faster deliveries and fulfillment centers. Amazon hired over 175,000 extra workers. And Shopify bought logistics company Deliverr for over $2 billion because of the belief that we entered a new paradigm of commerce.

COVID was supposed to be the accelerant that catapulted many shoppers into online shopping.

Turns out, it really was a novelty. And we’ve reverted to the mean.

Amazon, Shopify, Meta and others admitted they were wrong in public mea culpas. They over-hired and overspent.

They’ve since cut thousands of jobs and departments because of this. Now we’re back to normal. And e-commerce is back to just linear growth in the U.S.

The more things change, the more they stay the same.

Good investing,

Lance