Get Paid To Wait | Get Paid Doing Nothing | IPO Awakening

Here are three stories that caught our eye this week:

1) Get Paid To… Wait For A Job

Times have changed.

There was no “guarantee” of getting a job after college. It was a big source of anxiety for college graduates after the Great Recession.

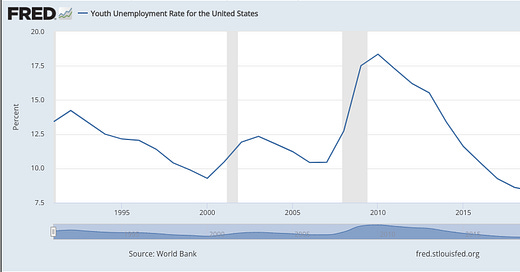

Youth unemployment was around 15-18% several years after the Great Recession. Then the labor market continued to tighten.

We now have the tightest labor market ever. We spoke about how lucky we are in the U.S. relative to China earlier this month in terms of employment. Specifically youth unemployment.

Companies are now paying people (mostly college graduates) to not work at all.

From Bloomberg (emphasis added):

“It’s the first time in decades start dates have been pushed back while top firms, including KPMG LLP and Ernst & Young LLP, have simultaneously laid off new recruits, according to the Wall Street Journal.

In April, the WSJ reported top firms had offered MBA graduates stipends in exchange for a delayed start date including $40,000 to work at a nonprofit, $30,000 to learn a new language, and $20,000 to become a yoga instructor. Law firms, by contrast, have offered first-year associates $75,000 or more to delay their start dates, according to Bloomberg Law.

And now, undergrads in consulting have received their own “personal enrichment” opportunities. Accenture and Bain told some incoming analysts they could receive up to $25,000 if they start April 2024 or later. Deloitte has offered new hires $2,000 for every month their start date is delayed.”

Companies don’t want to lose their pipeline of graduates. So they’ve done the math. It’s still economical for them to do so.

But are you kidding me? $40,000 for a 6-8 month delayed start date… to work at a nonprofit?!

I’m sure many of you are shaking your heads. I’m shaking mine while writing this.

This goes to show you how much money is still in the system. It is 100% inflationary. As these “kids” can simply get a part time-job in the interim. Party. Or go on vacation.

I know what I was doing between the ages of 21-25 years old. Looks like kids will be kids.

Back to Bloomberg (emphasis added):

“In the weeks leading up to her graduation from Pomona College, Sophia Augustine thought she had it all figured out. She had gotten a job offer at Accenture Plc and had plans to live with two friends in New York starting in August.

Then she got a much-dreaded phone call. She, like hundreds of other new graduates this year, had a delayed start date. She would now report to work in April 2024, and for her troubles she’d receive a $25,000 stipend. The sudden change made her nervous, but she quickly pivoted. She found someone to sublet her apartment and made travel plans, starting with a trip to Southeast Asia.

“I never got to study abroad in college because of Covid,” Augustine said. “So I'm viewing this as, just like, my golden opportunity.”

Only in America…

2) Get Paid To… Not Operate Your Business

Show me the incentive… I’ll show you the outcome.

If your business model is to produce anything… you’re going to do so profitably.

If it’s profitable, you can scale to infinity. If it’s unprofitable… well then you’re out of business. And some other company will take that market share in their endeavor to be profitable.

That’s the beauty of capitalism.

But what if your business is to mine Bitcoin? Mining means using computers to solve difficult mathematical equations.

The price of Bitcoin has to be greater than the cost to mine it. That includes the mining rigs and electricity, among other things.

Well, in the perverse world of how carbon credits get distributed, Bitcoin Miner Riot Platforms Inc. made millions from… not mining Bitcoin?

From Bloomberg (emphasis added):

“Bitcoin miner Riot Platforms Inc. made millions of dollars by selling power rather than producing the tokens in the second quarter as the crypto-mining industry continued to grapple with the impact of low digital asset prices.

The Castle Rock, Colorado-based company had $13.5 million in power curtailment credits during the quarter, while generating $49.7 million in mining revenue. Riot booked $27.3 million in power curtailment credits last year and $6.5 million in 2021 from power sales to the Electric Reliability Council of Texas, which is the grid operator for the Lone Star state…

…The miner, which operates one of the world’s largest Bitcoin mining facilities in Texas, has made tens of millions of dollars during the hottest months in the state as power demand reached record high amid the heat waves.”

It’s a concept you won’t find too often. Get paid more doing nothing than doing what your business was incorporated for. Odd.

But you can’t fault Riot Platforms. Their incentive is to make money. Plain and simple.

If they’re going to get paid to sit on their hands, then so be it. They have every right and incentive. We’re not going to fault them. That’s capitalism.

It’s just ironic.

(This section was inspired by Bloomberg’s Matt Levine. Levine is one of the best financial writers of our generation. So we recommend you read his take on the subject here.)

3) The Battle For IPOs

The all-clear sign was given back in June.

We’re talking about the green light to take your company public.

Markets have been ripping. And stock prices have been soaring on their first days as public companies.

Now, there’s a frenzy amongst the exchanges.

The Wall Street Journal calls it the “IPO Awakening.”

From The Wall Street Journal:

“The fight between the New York Stock Exchange and Nasdaq to win new stock listings is raging again, in another sign the market for initial public offerings is perking up after a long slumber.

The Nasdaq recently won grocery-delivery company Instacart’s listing, set to take place before year-end, according to people familiar with the matter. The exchange also successfully wooed Arm, the big chip designer. NYSE snagged the listings of marketing-automation platform Klaviyo and trendy German shoe manufacturer Birkenstock.

Exchanges make money each time a stock they host changes hands, but trading volumes are unpredictable. Listing fees, by contrast, are stable, and can add up to as much as a half-million dollars a year per company. Winning big listings confers coveted bragging rights.

Nasdaq and NYSE compete for all big IPOs, using inducements such as expensive marketing and advertising packages, fancy coming-out parties and opening- and closing-bell ringing privileges…

The IPO market has been in a prolonged slump, with companies raising the least amount of money in 2022 through traditional IPOs in at least two decades. Early 2023 was also slow, with companies and investors steering clear of IPOs, in part because of higher interest rates and inflation that have made other investments more attractive.

While that temporarily quieted the listing wars, in recent months they have started to pick up again.”

These companies know the IPO window is open. Yet, no one knows how long it’ll stay open for based on all of the economic crosscurrents.

But there’s billions of dollars on the line for investors and executives. It’s the way to hit pay dirt. So they’re rushing as fast as possible to go public before the window shuts.

Good investing,

Lance