Agencies' AI Disruption Moment | Oil Companies Against Deregulation | Texas Pacific AI Catalyst

Here are three stories that caught our eye this week:

1) Agencies’ AI Disruption Moment

Ad agencies are disrupting themselves.

Their business model, historically, has been charging clients based on the number of hours worked.

This is an extremely lucrative business model. Not just for agencies. Because the incentive to get paid is based on the hours worked… not quality of output.

Ad agencies are forced to change their business model now that AI is taking over the world.

These agencies are realizing they can produce the same amount of work for a fraction of the hours.

But that means they can’t bill as much. So they’re now having to think of how to bill their clients appropriately.

Want to guess what their solution is? Quality.

From the Wall Street Journal (emphasis added):

“Advertising agencies’ ability to work more efficiently because of AI may upend the way those agencies make money.

Agencies have long billed marketers by the number of hours their employees spend producing client work, using rate cards to charge different amounts for contributions by people according to their role.

Now, AI is eroding the number of people, hours and roles required to deliver for clients, and agencies may find the standard billing arrangement comes up short. AI is helping agencies rapidly produce personalized creative images, for example, or altering elements like color, position, lighting and language—tasks that were once highly manual. It’s also letting copywriters, who once may have needed several hours to write 50 variations of copy for a given ad, now generate 100 variations immediately, then choose to edit and curate them…

Billing for time doesn’t explicitly account for everything agencies do, including valuable aspects of a creative campaign such as generating strategic insights and big ideas, but it helps them cover such costs and keep the marketing machine humming…

Some agencies and their marketer clients are moving over to pricing that pays based on what they deliver or measurable results, meaning they get paid a certain amount regardless of how long a task took to do.

That also creates a better incentive structure for agencies to create good work, some industry leaders say.”

Such a novel idea. Charge based on meaningful work and measurable results.

There’s a lot of talk about the negative aspects of AI disruption.

But this could be the most beneficial use case of AI disruption: Get paid based on the quality of their work.

Agencies are disrupting themselves. They’re proving how absurd their business model was. Of course, some agency employees are going to kick and scream to hold the line.

“When you’re being paid on effort, it’s a very clear, measurable thing,” said Samrat Sharma, the leader of the marketing transformation unit at professional services company PwC US said. “You put in an hour, you get paid an hour, etc. When it’s done on outcomes, there’s a lot of variables, and therefore there’s a lot of risk.”

Sharma is right to be nervous. However, companies will always look to outsource some work in areas that aren’t in their core competency.

But we’re not far away from said company hiring (in-house) a couple of AI prompting / marketing specialists to do the work of entire agencies.

That’s a real extinction moment.

For now, we’ll have a good laugh at these agencies squirming at the thought of billing based on good work.

2) Oil Companies Against Deregulation

You’d think most major oil companies would be welcoming Trump’s promise to remove Biden’s red tape to drill oil when he assumes office.

But you’d be wrong.

Many of the biggest oil companies are trying to persuade Trump to keep these regulatory barriers in place.

Why? Regulatory capture.

From Wall Street Journal (emphasis added):

“Donald Trump has promised to remove Biden-era regulatory barriers to drilling oil and gas, and that has become even easier with Republicans’ House majority. Over the weekend, Trump nominated Chris Wright, an outspoken fossil-fuel champion, as energy secretary, further cementing the new administration’s pro-drilling stance. It isn’t exactly music to the ears of the biggest oil producers, though.

Take methane emissions regulation, which the Trump administration might roll back. Industry lobbying groups such as the American Petroleum Institute and the American Exploration and Production Council oppose the methane fee that was part of the Inflation Reduction Act. The fee starts at $900 per metric ton of methane emissions from operations—such as from wells and pipelines—that exceed a specified level this year, and steps up gradually to $1,500 in 2026 and beyond. Interestingly, Exxon Mobil has expressed support for the methane fee, and TotalEnergies’ chief executive has warned that rolling back methane regulations would ruin the industry’s reputation.

…Sure, Biden pushed enormous subsidies for green energy and tried to discourage fossil-fuel production, but his term hasn’t been so shabby for big oil companies. In the four years through the end of 2024, the four largest companies in the S&P Oil & Gas Exploration & Production Industry Index are expected to have generated more than $330 billion in free cash flow, according to FactSet. Under Trump, they generated just $91 billion.”

Regulatory capture is simple.

Get big enough. Then support regulation to keep competition away.

This is happening in nearly every major industry. From airlines to tech to pharmaceutical companies.

The funny part? The methane fee hasn’t even been implemented yet. The producers have no idea how much they’re going to pay.

But the major oil producers know whatever it is… it’ll be costly for any of the small producers. More from WSJ (emphasis added):

“It isn’t yet clear exactly how much companies might owe in methane fees—the Environmental Protection Agency’s final rules on that were only announced on Tuesday. Based on analysis conducted earlier this year, Wood Mackenzie U.S. upstream energy analyst Ryan Duman suspects the fees will probably hit the smaller producers disproportionately while some of the biggest producers might not even be subject to them. Small-capitalization oil and gas producers’ methane intensity declined by a third between 2019 and 2023, while that of major oil companies fell by 57% over that period, according to data from Wood Mackenzie.”

Competition is good. Regulatory capture is bad.

Hoping Trump removes Biden’s regulatory red tape isn’t about environmentalism. It’s about capitalism.

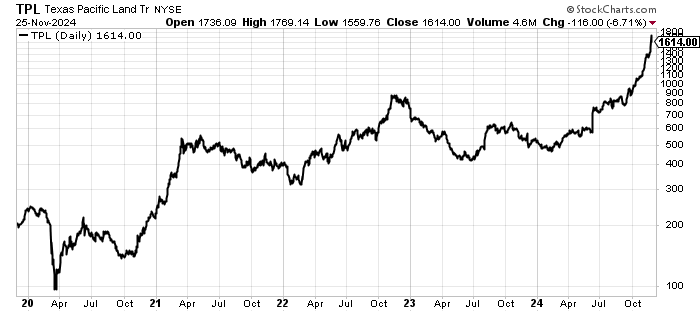

3) Texas Pacific Land Trust Cashes In On AI

Longtime readers are familiar with Texas Pacific Land Trust (TPL).

It’s a trophy asset — one you want to hold “forever” — which we’ve written a lot about over the past couple years.

TPL is one of the largest landowners in Texas. And earns royalties on every gallon of water, oil, and gas produced on its land in the Permian Basin in Texas.

(We also traded it back in 2021 and booked a 36% gain in four months.)

TPL is up 4x since we last wrote about it.

It’s continuing to soar despite oil prices being down about 45% from their 2022 highs.

That’s the beauty of royalty companies.

And it’s why royalties are a key pillar within our Income Fund. (If you’re interested in learning more about our Income Fund, reply back to this email.)

Texas Pacific Land Trust is surging because it too is an AI beneficiary. Here’s Bloomberg (emphasis added):

“A Texas land company founded during the Wild West era more than a century ago is becoming an unlikely beneficiary of market euphoria over artificial intelligence…

Bitcoin mines, utility-scale batteries and renewable power are already being built on TPL’s 873,000 acres in West Texas, an area bigger than Yosemite National Park. But that could be just the beginning. The swath of land in the oil-rich Permian Basin, where natural gas costs almost nothing, is an opportunity for tech giants like Google owner Alphabet Inc., Microsoft Corp. and Amazon.com Inc. to access cheap electricity for energy-hungry servers.

AI’s potential to revolutionize how people live, work and play has been the driving force behind the S&P 500 Index’s 50% rise over the past two years. But to realize the real-world profits implied by their stock valuations, Big Tech is plowing money into physical infrastructure. Alphabet, Microsoft, Amazon and Facebook owner Meta Platforms Inc. are expected to spend more than $200 billion next year, according to data compiled by Bloomberg, much of it on data centers…

“This is the AI-adjacent pick and shovel trade,” said Kevin Simpson, who helps manage $11 billion, including TPL shares, as chief executive officer of Capital Wealth Planning LLC. “These are not obscene valuations if the data center thesis plays out.

Now investors are thinking further ahead. With a ChatGPT query using nearly ten times as much electricity as a Google search, US data center power demand is expected to grow about 170% by 2030, according to Goldman Sachs Group Inc. “This increased demand will help drive the kind of electricity growth that hasn’t been seen in a generation,” the bank said in May.”

TPL doesn’t need the AI catalyst to be one of the best publicly traded trophy assets.

It will earn royalties till the end of time. For as long as oil companies drill on its land.

We’re being rewarded with an increasing share price… and a growing dividend.

TPL has grown its dividend by almost 15% annually over the past seven years. Plus they’ve paid a couple of massive special dividends too.

This AI catalyst is another ace in the arsenal. And what makes TPL one of the best stocks to own for decades to come.

Good investing,

Lance