Here are three stories that caught our eye this week:

1) Artificial Pop

Rapper and producer Timbaland is pioneering a new music genre.

A-pop.

Artificial pop music.

“I’m not just producing tracks anymore. I’m producing systems, stories, and stars from scratch.” Timbaland told Billboard.

Timbaland is about to debut a new album from TaTa.

TaTa isn’t an up-and-coming music star in the traditional sense. She’s an artificial intelligence bot. From MusicRadar.

“[TaTa] is not an avatar. She is not a character. TaTa is a living, learning, autonomous music artist built with AI. TaTa is the start of something bigger. She’s the first artist of a new generation. A-Pop is the next cultural evolution, and TaTa is its first icon.

“The artists of tomorrow won’t just be human, they’ll be IP, code and robotics that are fully autonomous. That’s what we’re building at Stage Zero,” says film producer Rocky Mudaliar.”

A-pop is, and will be, a new phase of music.

Music labels, artists, musicians, and the like can all create music from a prompt.

You, dear reader, can now create any “original” piece of music in the palm of your hand. The only limitation is your own creativity.

Music labels are scrambling. That’s why they’re suing these AI music companies.

They fear AI music will flood the streaming platforms… they’ll drown out and reduce the amount of streams from a real artist’s music. (It feels weird writing that.)

The fundamental question of copy-written work is playing out in the courts. We’ll soon find out whether these AI companies need to pay licensing rights and royalties to the labels.

What comes next is anyone’s guess. But we’re ushering in the new phase of music.

2) Music Labels Start Talking To AI Companies

We didn’t expect “talks” to happen this fast between music labels and AI companies.

Music labels were suing AI companies as much as $150,000 per work infringed. That amounts to tens of billions of dollars.

But “discussions” started happening already.

The music labels — Universal Music Group, Warner Music Group, and Sony Music Entertainment — are likely starting to realize where music is headed with A-pop.

The music labels asking for licensing royalties isn’t what’s surprising. What’s surprising is another detail amidst the talks. From Bloomberg (emphasis added):

“Universal Music Group, Warner Music Group and Sony Music Entertainment are pushing to collect license fees for their work and also receive a small amount of equity in Suno and Udio, two leaders among a crop of companies that use generative AI to help make music. Any deal would help settle lawsuits between the two sides, said the people, who declined to be identified because the talks could fall apart…

The music companies and the AI startups are talking to see if they can agree on terms rather than continue to fight in court. The negotiations are happening in parallel, creating a race of sorts to see which AI company and label will strike a deal first. The talks are complicated because the labels are pushing for greater control over the use of their work, while Udio and Suno are seeking flexibility to experiment and want deals at a price reasonable for startup companies.”

The music labels typically negotiate for the max royalty per stream.

But now they’re negotiating for equity in these AI companies.

This reveals a concession of sorts. That the music labels know AI is the future of music. And they don’t just want to collect future royalties. They want to participate in the equity upside of these companies altogether.

The upside in what these AI companies could be worth is greater than the amount of royalties they’ll earn over the course of years… or even decades.

What the terms are going to be, and how long, will take months, if not years.

The Bloomberg article said the negotiations are happening in parallel to the suit. So worst case scenario for the labels is billions of dollars in copyright infringement payments.

The AI music companies are going to push forward regardless. They’re backed by big VC firms. And, like Uber, will push forward for market share until they come to terms.

3) Continuation Funds

That’s what the private equity world has turned to.

Returns and distributions have been so bad, these private equity funds are giving existing investors a way to cash out… by selling them to new investors.

They’re called continuation funds. From Bloomberg (emphasis added):

“Private credit firms are flooding the market with continuation funds, as a lack of mergers and acquisitions, a fundraising drought and US tariff-induced volatility force them to find other ways to return cash to investors.

These vehicles are a type of secondary transaction, once reserved for private equity firms that needed to hold on to their investments longer. Managers can roll over an existing portfolio of assets into a new fund with new investors. Existing limited partners can cash out without waiting for loans to be paid off or refinanced…

Historically, LPs have conducted the bulk of secondary deals through offloading their stake in a portfolio to another investor. But direct lenders themselves are now bringing deals to market. Firms such as Benefit Street Partners and TPG Twin Brook Capital Partners have each launched transactions worth at least $1 billion in recent months.

Secondary deals led by general partners made up less than a third of all private credit secondaries as of January, but that share is expected to increase to more than 50% this year, according to data from Jefferies Financial Group Inc.

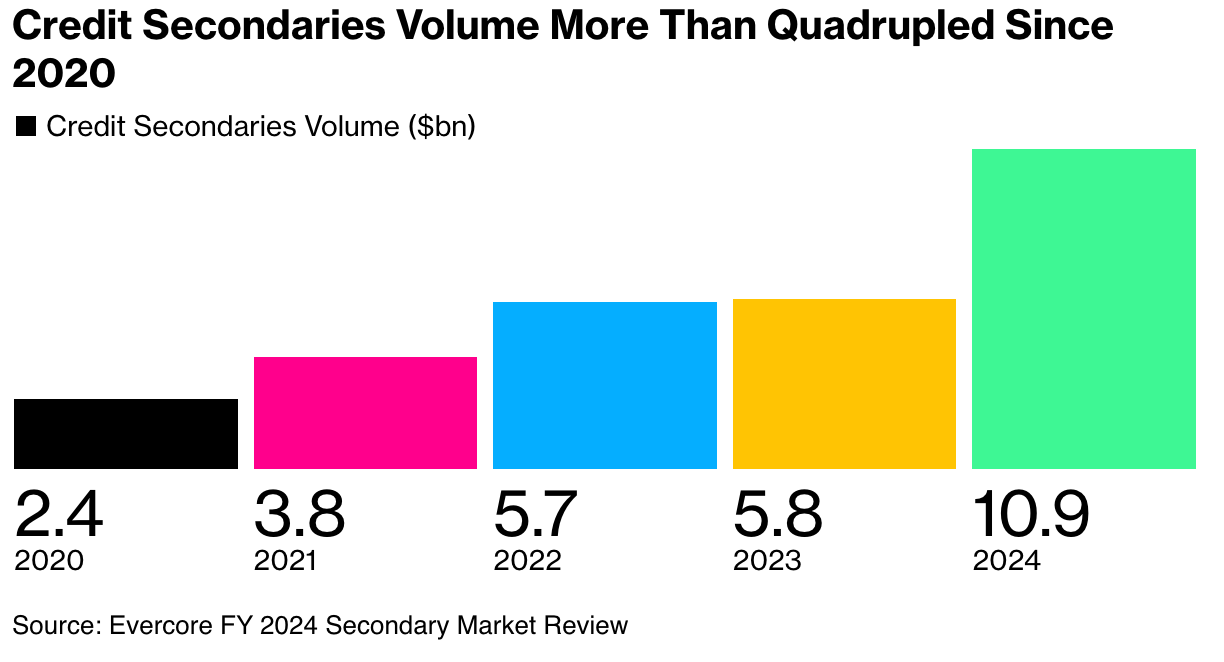

The total volume of credit secondaries deals has rapidly risen since 2020, reaching a record $10.9 billion last year, according to data from Evercore Inc…

Continuation funds can be used by firms as a “backdoor” for fundraising, according to Cocke at Corbin Capital Partners…

Ultimately, continuation vehicles allow a private credit fund to give investors the option to sell out of one fund — “hopefully relatively close to the mark” — and use some of those proceeds to reinvest into a new fund, said Ed Goldstein, the chief investment officer of Coller Capital’s credit secondaries arm.”

We’ve written about private equity and hedge funds struggling to return capital. (You can read them here and here.)

But continuation funds are not a good sign for the industry.

(That’s why we — at The Partners Fund — are primarily an income fund. We pay distributions every quarter to our Partners.)

Raising new capital from new investors to pay existing investors. Sound like something you’ve heard about before?

Good investing,

Lance

DISCLAIMER: This is solely our opinion based on our observations and interpretations of events. This should not be construed as personal investment advice.